how employee check their socso contribution

Hanna is quite helpful. However the employees are now selective with the contribution 7 or 11 of their salary.

Employer Contribution Of Epf Socso And Eis In Malaysia

Employers are not required to fill in bank slips.

. This is because according to The Malay Mail employers who havent registered or paid their employees Socso contributions will be investigated during a nationwide hunt for errant employers in. Company Name Please keyin 3 character and select company Loss of Employment date LOE Loss of Employment date shall be one day after last day of employment. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act.

The first option is to call to SOCSO customer careline at 1300 22 8000 Monday to Friday 8 am to 5 pm. The rate of contribution is capped at monthly wage ceiling of RM400000. ILPC can be paid at RHB Bank and Public Bank by submitting an ILPC statement to the bank to stamp the date received and by stating the SOCSO account number.

However for the case of employee whom ages have reach above 60 EPF have an arrangement for them by lowering their contribution to 0 a month instead of pervious 11 a month. Click on Add Contribution Portal. For each employee or put it EPF member which is contribute 11 of their salary.

In short yes bonuses and cash allowances are considered to be part of your wages. Check the status of their SOCSO contribution online. Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act.

If you want to confirm your SOCSO number you can call the agencys hotline at 1-300-22-8000. In addition to monthly salaries Malaysian employers are also bound to contribute to the EPF EIS and SOCSO accounts of their employees. This will come under the.

Employers must fulfil their monthly contributions to SOCSO no later than the 15th of following month. Your SOCSO number is the same as your IC number if you are a Malaysian resident. SOCSO contribution is to protect employees working in Malaysia by way of compensating them in the event that they suffer from work related injuries.

Socso Sarawak in a statement yesterday said any. The percentage of SOCSO Contribution shall between 3 to 5 of the employee salary vary accordingly to the employee salary amount. SOCSOs Offices If an employer wishes to make payments directly as SOCSOs offices itself SOCSO only accepts payments in the form of cheques or postal money order.

Employers will then have to submit a completed application form and the employees name and the SOCSO contribution data required. Its now easier to make payments to Socso via online banking. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary.

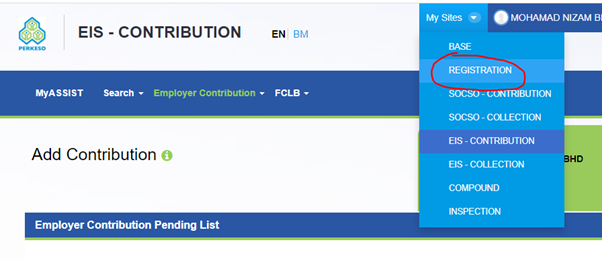

After 13 employers fined MTUC urges workers to check Socso accounts. Late payment cheques for each month ILPC is issued separately. On the right side of the page click on My Sites and then click on SOCSO Contribution.

For a breakdown of how much you and your employers contribution should be click here. Malayan Bank Maybank RHB Bank. File a report or to make SOCSO claim.

For example employee A earns RM6000 per month as their basic salary. The SOCSO hotline can be contacted at 1-300-22-8000 for verification of your SOCSO number. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

Pseudo Code Passport No. Both the rates of contribution are based on the total. SOCSO announced an increase for its pension rates on 8 November 2017.

Once registered employer and employees are able to check their contribution online by using their Identity Card Number NRIC. Why is SOCSO contribution deem important in Malaysia. Moreover you simply can check your payslip.

Your SOCSO number should be there. Provide feedback for services related to SOCSO. Making payments through the banks Employers can make payment through the following branches.

You may try out chatting and checking with SOCSO Chatbot. Among the above the most important part is iPERKESO allows SOCSO members to view and monitor their contributions online. The Vibes file pic February 12 2022.

SOCSO Contribution is a payment to Social Security Organization made by both employees and employers. Employers in Sarawak are reminded not to delay paying the monthly Social Security Organisation Socso contributions for their workers. Hover over the Employer Contribution link located on the left side of the page on the ASSIST portals main navigation bar.

There are 2 ways an employer can easily go about making their payments to SOCSO. If you still want to confirm your SOCSO or PERKESO number you may use the following method. ILPC can also be paid at all SOCSO offices.

Making Payments to SOCSO. Make sure your employer contributes on your behalf you can check your status at eSemak or at SOCSO branches. Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia.

Employees Eligibility All employees who are employed under a contract of service or apprenticeship in the private sector and contractual temporary staff of Federal State Government as well as Federal State Statutory Bodies need to be registered and covered by SOCSO. Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. Contact SOCSO customer careline.

All such contributions are required by the Malaysian Legislation. The answer according to the official EPF website is clear. Additionally you can speak with a representative on the PERKESO.

Socso director Nora Yaacob said that from January last year to February 10 the 13 employers were issued arrest warrants and fines amounting to RM17600. SOCSO Contribution shall be made for each month of salary payment as a deduction towards salary net pay. You can also talk to a representative through the PERKESO website.

If youre an employer you might want to double check whether you have registered or paid your employees Social Security Organisation scheme Socso contributions. This contribution is paid into Employee Provident Fund or KWSP in Malay. The rate of SOCSO contribution will depend on your salary.

How Do I Check My Perkeso Contribution. In addition contributions are also made to Social Security Organization or PERKESO in Malay.

Employer Contribution Of Epf Socso And Eis In Malaysia

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Slip Gaji Merupakan Bentuk Tanda Bukti Atas Gaji Atau Pembayaran Untuk Seorang Pekerja Adapun Pentingnya Slip Gaji Adalah Memberik In 2021 Payroll Template Slip Names

Letter Compulsory To Register Domestic Workers With Socso

.png)

Employers Must Know Employment Injury Scheme For Foreign Workers

5 Things You Should Know About Socso

New Minimum Wage And Socso Requirements Donovan Ho

Myfreelys Academy Pekerso Definition Of Wages For Socso Contribution Purpose Wages For Contribution Purposes Refers To All Remunerations Payable In Money By An Employer To An Employee Among The Remunerations Are

Employment Injury Scheme For Foreign Worker

Walk In Online Malaysia Foreign Worker Insurance Scheme Arranged By Acpg Management Sdn Bhd 03 92863323 011 12239838 Whatsapp Www Acpgconsultant Com Whatsapp For Enquiry Please Click Here Http Wasap My 601112239838 Foreignworkerinsurance Our

How To Add A New Employee In Assist Perkeso Portal

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Socso Contribution Chart Table Rates Chart Contribution Employment

Socso Who Is Employee Nbc Com My

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

0 Response to "how employee check their socso contribution"

Post a Comment